We would like to hear from you with any feedback about our website or products.

Effective Day Trading Strategies for Forex Success 1612288157

Effective Day Trading Strategies for Forex Success

Success in Forex day trading isn’t just about luck; it requires solid strategies and risk management. Understanding how to trade in the Forex market effectively can be a game-changer. In this article, we will delve into various strategies that traders employ for day trading in the Forex market. You can also review the forex day trading strategies Best Saudi Brokers to make informed choices.

1. Understanding Day Trading in Forex

Day trading refers to the practice of buying and selling financial instruments within the same trading day. Forex day traders take advantage of small price movements to make profits. Unlike long-term investors who hold positions for weeks or months, day traders aim to capitalize on intra-day price fluctuations. This requires a robust understanding of market dynamics, technical analysis, and effective timing.

2. Key Principles of Forex Day Trading

To be successful in Forex day trading, there are several key principles that traders should follow:

- Risk Management: Always set stop-loss orders to protect your capital and minimize losses.

- Keep Emotions in Check: Day trading can be stressful; it’s crucial to maintain discipline and avoid trading based on emotions.

- Stay Informed: Keep up with economic news and events that can impact currency prices.

3. Popular Day Trading Strategies

Here are a few popular day trading strategies used in Forex trading:

3.1 Scalping

Scalping is a strategy that involves making numerous trades throughout the day to capture small price movements. Traders using this technique usually rely on strict risk management and quick decision-making skills. Scalping requires a fast internet connection and a reliable trading platform.

3.2 Breakout Trading

Breakout trading involves identifying key price levels and entering a trade when the price breaks above or below these levels. The idea is to capitalize on the momentum that typically follows a breakout, with traders anticipating a significant move in the direction of the breakout.

3.3 Trend Following

Trend following strategies involve identifying the overall direction of the market and trading in that direction. Traders will often use technical indicators like moving averages to evaluate the strength of the trend and place trades accordingly. This strategy relies on the assumption that prices will continue to move in the same direction.

3.4 Range Trading

Range trading is based on the concept that prices often bounce between established support and resistance levels. Traders identify these levels and make trades when the price approaches them. This strategy is effective in a sideways market where there are no clear trends.

4. Technical Analysis Tools

Successful day traders rely heavily on technical analysis. Here are a few essential tools:

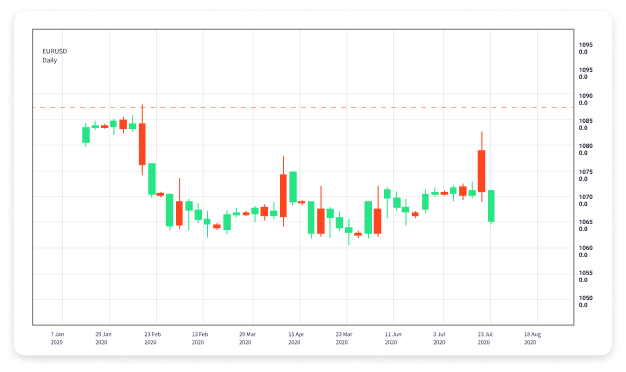

- Charts: Candlestick and line charts help traders visualize price movements over time.

- Indicators: Tools like Relative Strength Index (RSI) and Bollinger Bands can provide valuable insights into market conditions.

- Support and Resistance Levels: Identifying these levels can provide entry and exit points.

5. Psychological Aspects of Day Trading

The psychological aspect of trading can significantly impact a trader’s success. Fear of missing out can lead to hasty decisions, while fear of loss might prevent traders from executing winning trades. Developing a solid trading plan and sticking to it can help mitigate these emotional challenges.

6. Creating a Trading Plan

A well-defined trading plan is essential for any day trader. It should include:

- Your trading goals and objectives.

- Risk tolerance level and money management rules.

- The strategies you will employ and your entry/exit criteria.

- A review process to analyze your trades and improve your performance.

7. Choosing a Forex Broker

Selecting the right Forex broker is crucial for day trading success. Look for brokers that offer:

- Competitive spreads.

- Fast order execution.

- Robust trading platforms with advanced tools.

- Excellent customer support.

Researching and comparing brokers will help ensure you make informed decisions that align with your trading style.

Conclusion

Forex day trading can be a profitable venture if approached with the right strategies and mindset. Understanding the market, employing effective trading techniques, and maintaining discipline are essential for long-term success. By applying the strategies discussed in this article, traders can enhance their skills and work towards achieving their financial goals.