We would like to hear from you with any feedback about our website or products.

Upgraded 1 Oct 2025 Better Singapore Repaired Put Costs and you can Savings Accounts

Content

In order to allege exception, you need to render your boss an application W-4. Make “Exempt” for the setting regarding the area below Step 4(c) and complete the relevant tips of one’s function. To be qualified, you must have been purchased the same kind of payroll period (each week, biweekly, an such like.) since the beginning of the year. For many who alter the level of your withholding inside the seasons, excessive or too little income tax may have been withheld for the period before you generated the alteration. You happen to be in a position to compensate for it if the workplace believes to utilize the newest cumulative wage withholding opportinity for the remainder of the season. You must ask your boss on paper to utilize this procedure.

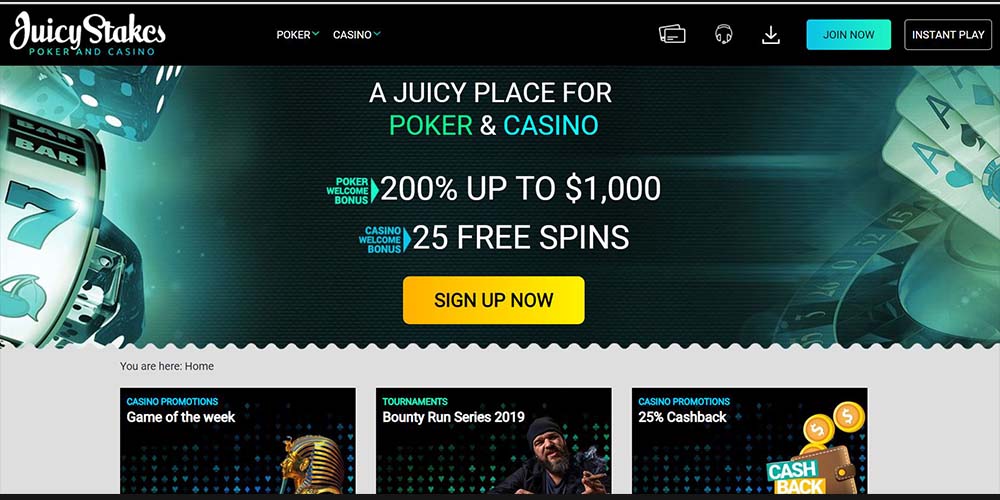

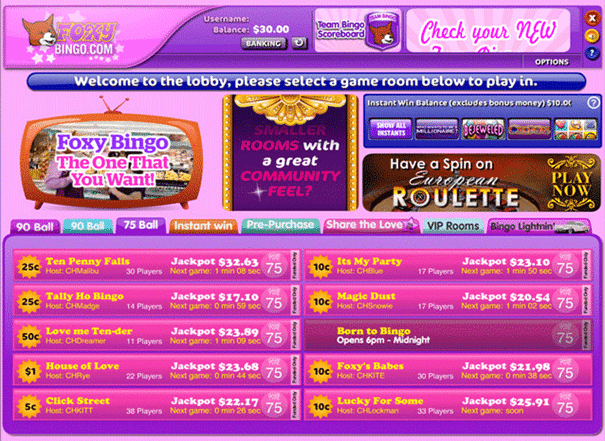

Kind of $step 1 minimal put bonuses

On the a college time, the child is actually treated since the lifestyle during the primary home inserted for the school. However, if it will’t end up being calculated that father or mother the little one normally will have resided or if perhaps the little one wouldn’t has existed with both mother you to evening, the kid try treated as the not-living which have sometimes father or mother you to definitely evening. People away from separated or separated parents (or mothers who happen to live aside).

Major Businesses

- The fresh point 179 deduction and you can special depreciation allowance try handled because the depreciation for reason for the new limits.

- So it borrowing differs from plus on the borrowing from the bank for man and you can based care and attention costs that you might also be eligible to claim.

- While you are a good voluntary firefighter or disaster scientific responder, don’t include in your earnings the next pros you can get out of your state otherwise state government.

- You probably depreciate the expense of an auto, truck, or van over a period of 6 schedule many years.

- When you’re a federal personnel participating in a national offense study or prosecution, you aren’t at the mercy of the new step 1-season laws.

The new floodgates to possess court sports betting over the United states exposed within the 2018, however it took a bit to have what you should get moving inside Florida. Here’s the whole schedule https://happy-gambler.com/book-of-ra-deluxe/rtp/ away from how it features all of the played away. The fresh individuality of one’s market extends to the brand new regulation out of Florida sports betting. Within the 2021 playing lightweight, the new Seminole Tribe have power over and you can works wagering in this the state.

The reason being another father or mother’s AGI, $14,one hundred thousand, is more than your own AGI, $12,100. For those who stated the child income tax credit to have Marley, the new Internal revenue service usually disallow their state they so it borrowing from the bank. However, you’re capable allege the brand new attained money borrowing from the bank because the a good taxpayer instead a good qualifying boy.

Release Twist Local casino on the popular cellular internet browser, and availability the same game, percentage actions, and account features as the pc web site. Detailed with all of our exclusive $1 deposit casino bonus away from 70 totally free revolves for the Mega Mustang position. You can use their same Spin Local casino log on back ground to play on the go rather than compromising quality. The big $step one minimum put gambling enterprises accept deposits out of multiple legitimate financial institutions, as well as those here.

This type of number are typically used in money on your own go back to have the season of the rollover from the qualified workplace plan to a good Roth IRA. More often than not, for individuals who receive professionals lower than a charge card impairment otherwise jobless insurance plan, the benefits is actually taxable to you. These arrangements make the minimum monthly payment on your bank card membership if you possibly could’t make the percentage because of burns off, issues, impairment, or jobless. Writeup on Plan step 1 (Function 1040), range 8z, the level of benefits your received in the year you to’s more than the degree of the brand new premium you repaid throughout the the entire year.

Qualifying People to your ODC

We might intimate their instance rather than transform; or, you can even receive a refund. Taxpayers feel the straight to pay just the level of income tax lawfully owed, in addition to attention and you can charges, also to have the Internal revenue service use all the taxation costs properly. A child is known as to have stayed to you for much more than just half of 2024 in case your boy was born otherwise passed away inside the 2024 plus family is actually so it kid’s family for lots more than simply 1 / 2 of committed the kid are real time.

Top 10 Better $step 1 Put Bonus Casinos online inside 2025

I believe a bonus must be a great and simple to help you claim. The top gambling establishment incentives can often simply be put on certain online casino games versions otherwise titles. Cautiously comprehend the promo’s conditions and terms before stating understand where you are able to make use of added bonus fund.

Years step 1 and you may six apply the fresh 50 percent of-year otherwise middle-one-fourth meeting to the calculation to you personally. For those who discard the auto in years dos due to 5 and also the half-season conference can be applied, then the complete year’s depreciation amount should be split by the 2. If your middle-one-fourth seminar applies, proliferate an entire year’s depreciation by percentage from the following desk to the quarter which you discarded the car. For five-seasons possessions, their healing months are six diary many years. A part seasons’s decline are invited in the 1st twelve months, an entire year’s decline is acceptance in the each one of the next 4 calendar many years, and you can a part seasons’s decline is invited regarding the sixth twelve months. The fresh conversation one to observe pertains to trading-in out of autos inside 2024, where election was created to treat the transaction because the a disposition of your old vehicle and also the purchase of the new car.